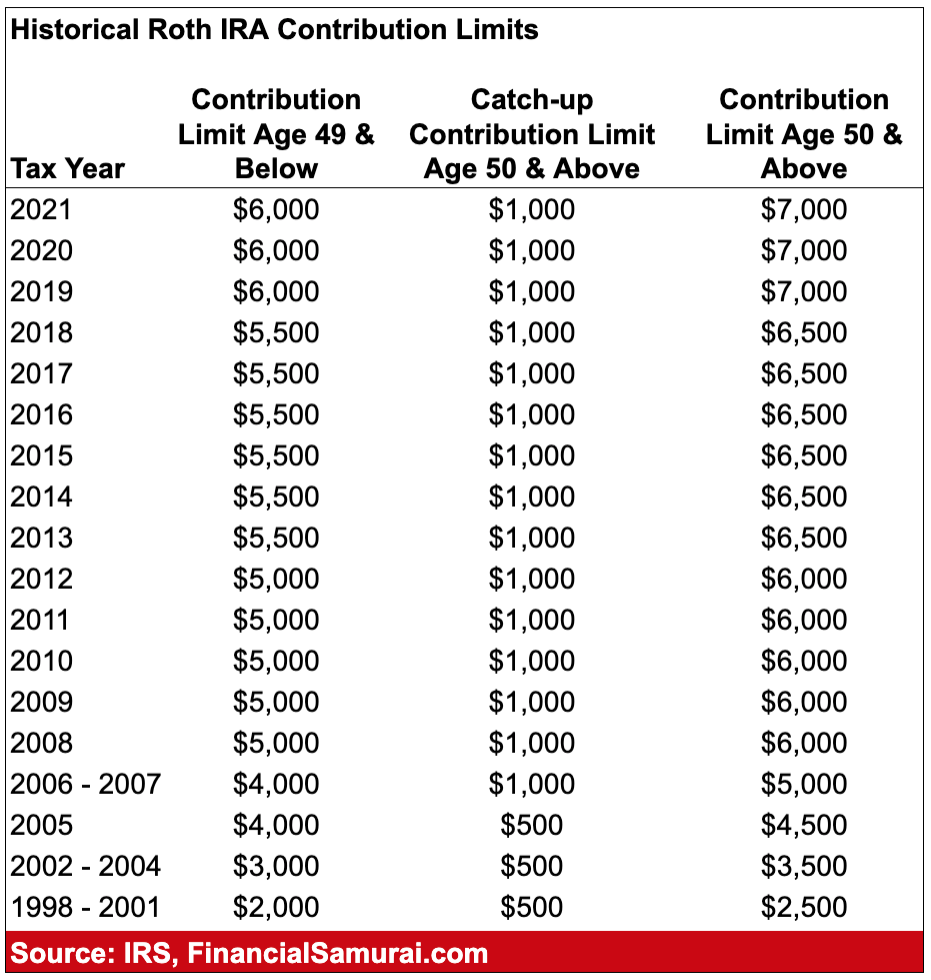

Roth Ira Salary Contribution Limits 2025. 2025 and 2025 roth ira income limits; The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older.

For 2025, the maximum amount you can contribute to a roth ira is $6,500 ($7,000 in 2025). Is your income ok for a roth ira?

401k Limits For 2025 Over Age 50022 Over 55 Sonia Eleonora, 2025 and 2025 roth ira income limits; The 2025 roth ira income limits are less than $161,000 for single tax filers and less than $240,000 for those married filing jointly.

401k Roth 2025 Contribution Limit Irs Rodi Vivian, You’re allowed to increase that to $7,500 ($8,000 in 2025) if you’re age 50 or older. Learn how to make the most of your 401k plan

IRA Contribution Limits 2025 Finance Strategists, The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older. Whether you’re contributing to a traditional ira, roth ira, or a combination, the 2025 contribution limit is $7,000, or $8,000 for those aged 50 and older.there.

Traditional Ira Salary Limits 2025 Aile Lorene, Less than $230,000 (married filing jointly) or less than $146,000 (single) reduced contribution income limits:. Roth ira contribution limits are rising in 2025.

Roth IRA Limits And Maximum Contribution For 2025, In 2025, the roth ira contribution limit is $7,000, or $8,000 if you're 50. The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you're age 50 or older.

IRS Unveils Increased 2025 IRA Contribution Limits, But your income and your (as well as your spouse's). The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

Opening A Roth IRA For Your Kids To Build Wealth And Save On Taxes, In 2025, the roth ira contribution limit is $7,000, or $8,000 if you're 50. Unlike with a roth ira, there's no income limit for those who can contribute to a traditional ira.

Is A Backdoor Roth IRA A Good Move For Higher Earners?, That means you'll be able to. Understanding ira contribution limits can help you avoid making excess contributions and paying 6% tax on them.

Ira Roth Contribution Limits 2025 Min Laurel, Learn how to make the most of your 401k plan Is your income ok for a roth ira?

Roth ira eligibility 2025 EzmiSaidou, The actual amount that you are allowed to contribute to a roth ira is based on your income. Those limits reflect an increase of $500 over the.

Roth Ira Salary Contribution Limits 2025. 2025 and 2025 roth ira income limits; The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older. For 2025, the maximum amount you can contribute to a roth ira is $6,500 ($7,000 in 2025). Is your income…